With 2023 expected to bring more of the same, we’re all looking forward to a bit of a slow down around the holidays, I’m sure. With everything from predictions of a recession, to a hot labor market, select reductions in force, high voluntary turnover, and slowing inflation, this planning cycle is rife with complexity.

In the recently published November 2022 version of the US Compensation Planning Survey, we see that, on average, the budgets employers are reporting for both merit increases and total increases have grown from those reported earlier in the year. Beyond this, the amount of change realized in year over year adjustments in base pay continues to grow. Let’s take a look at how much change is taking place and why.

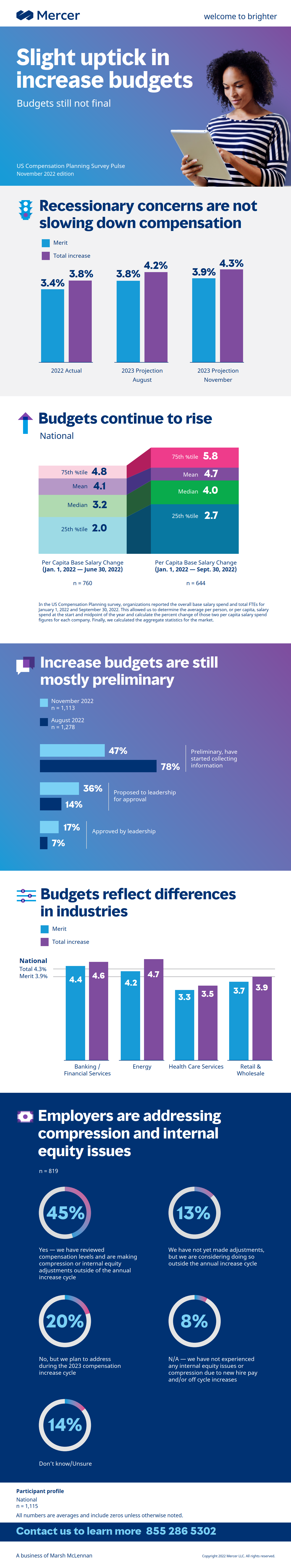

Merit and total increase budgets

On average, the merit and total increase budgets each increased one tenth of a percentage point from what had been reported in the prior pulse, published in August 2022. With merit increase budgets projected at 3.9% and total increase budgets projected at 4.3%, we are seeing a high that well surpasses anything we’ve seen in the last 15 years. However, with the other factors, such as a tight labor market and scarcity of talent alongside inflation, employees won’t likely feel that the annual increases they receive make much of a difference. Their dollars just don’t go as far as they used to.

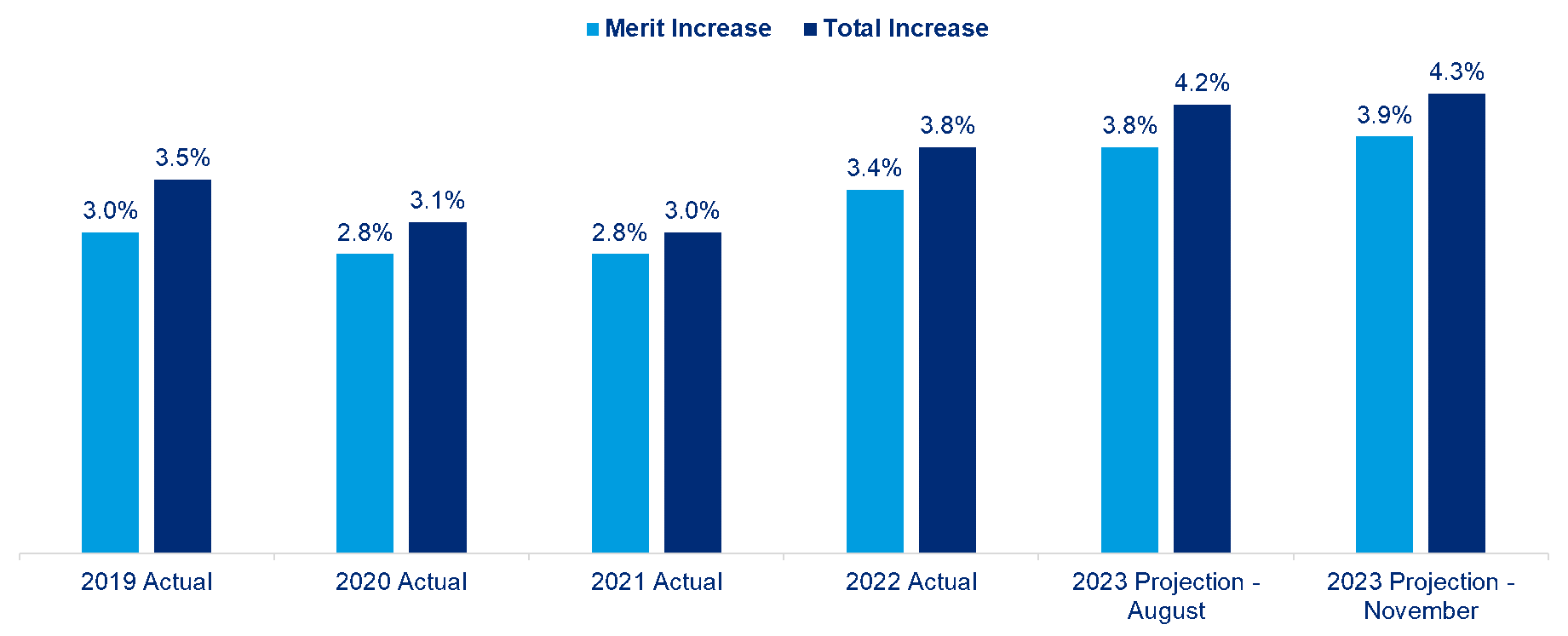

Additionally, we continue to find that the story is not the same across industries. Health care services and retail and wholesale continue to lag the cross-industry average while banking and financial services along with energy are leading the pack.

Compression and internal equity

Whether due to the higher wages required to get people in the door, pressure on minimum wage, or reconfiguring jobs and ways of working, compression between lower level jobs and those above means that employers have had to conduct additional pay reviews and implement off-cycle increases. Over half of all survey participants reported that either they have reviewed salaries and made adjustments for compression or other internal equities or they will consider doing so outside of the annual increase cycle.

Additionally, participants in the survey reported that from January 1, 2022 to September 30, 2022, base salaries increased an average of 4.7%, which exceeds budgeted total increases; this does include the impact of simple increases in internal minimum hiring rates, as well. Some industries are showing that they have had to make even bigger adjustments:

Although the 4.4% mean base pay change in healthcare does not rank at the bottom compared to other industries, it should be remembered that pay was low to begin with. The 4.4% increase doesn’t really better their competitive positioning across industries, which is particularly important for entry-level jobs.

Just how are those off-cycle increases being managed and distributed? Only 26% of employers in the survey reported budgeting for it. The remainder must have needed to find funds originally earmarked for other purposes, such as using salary dollars freed up by turnover. Not all employees are benefiting from these off-cycle increases either — it’s likely benefiting those in hard to fill or critical roles or those particular individuals with institutional knowledge who would be hard to replace. Almost 40% of employers responded that less than 10% of their workforce received off-cycle increases.

Status of budgets

At this point, 47% of the over 1,000 survey respondents are still reporting that their budgets are only in the preliminary phases. However, if their aim is to implement increases in the first quarter of 2023, it’s probably a matter waiting for the leaders to make decisions or January board meetings to move the approval process forward. Could budgets continue to change? It’s possible. Year-end financials are yet to be finalized and though typically able to be forecasted, the results of the holiday shopping season do tend to influence a variety economic factors. We’ll just have to wait and see.

In the face of much complexity and a lingering degree of uncertainty, stick to what you know to be the basis of good compensation practices. Seek out good information, listen to your employees, get pay right, and communicate the value of your total rewards package.

Do you have lingering questions on how to finalize your budgets for 2023? We’re here to help. Reach out to a Mercer associate at surveys@mercer.com or 1-855-286-5302.