Given today’s labor market, employers are focusing on attraction and retention strategies – and one of the hottest topics in these discussions is the lifestyle spending account (LSA). These accounts don’t have an official name, so you may know them as life accounts, lifestyle accounts, or life planning accounts, and employers and vendors have given them custom names like Choice Account and Benefits Your Way. At their core, LSAs are employer-funded accounts that employees use to support their individual needs. As we’ll explain, employers can design LSAs to be used for most types of expense or can target their use for very specific purposes.

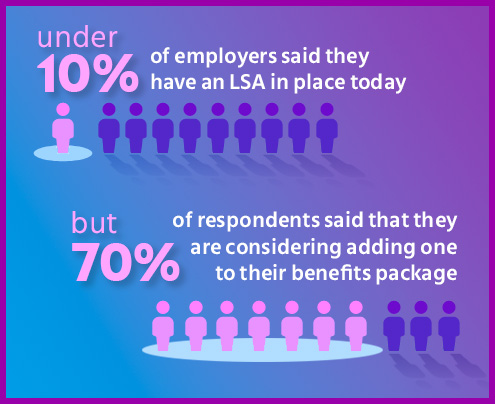

In our recent Mercer Insights survey, just under 10% of employers that responded said they have a LSA in place today – but a startling 70% of respondents said that they are considering adding an LSA to their benefits package. Maybe we shouldn’t have been so surprised by this result. When we discussed this topic on our recent LSA webcast, the questions came flooding in.

Here are our answers to the most-asked questions from our employer audience:

Why are LSAs suddenly so popular?

Although LSAs have been on the scene for five or six years now, it took today’s low unemployment rates to focus employers’ attention on this lever for better attraction and retention. One reason for the renewed interest – and the increased uptake – of these accounts is the flexibility LSAs offer for both employers and employees. First, employers can use LSAs to address employees’ desire for higher compensation without permanently increasing base pay, an ongoing commitment that can escalate over time. Second, LSAs are a way to address point solution overload. Rather than invest in another well-being initiative that employees may or may not use, employers can help subsidize a variety of services, products or experiences to fit employees’ very different lifestyles. Finally, employers pursuing diversity, equity and inclusion objectives may see LSAs as a straightforward way to address benefit gaps for female employees, specific racial/ethnic groups, LBGTQ+ individuals, or populations with special life needs, such as family building or emergency relief.

What is a typical LSA benefit design?

Employers fund the account and decide the scope of eligible expenses. Again, since LSAs are so flexible, there really isn’t a ’typical’ design. The list of eligible expenses can be very narrow or extremely broad. It's possible to have one core LSA that covers an expansive array of expenses (for example, fitness and wellness, financial planning, tuition/student loan repayment, child/elder care, pet care, etc.), and one or more separate LSAs to be used for specified expenses (for example, surrogacy or adoption, home office equipment, etc.). Each LSA can have its own design, eligible population, dollar amounts, funding frequency, reimbursement processes, and spending timeframe. And since LSAs generally are a taxable benefit, they’re not subject to nondiscrimination requirements under the Internal Revenue Code.

Each LSA can have its own design, eligible population, dollar amounts, funding frequency, reimbursement processes, and spending timeframe. And since LSAs generally are a taxable benefit, they’re not subject to nondiscrimination requirements under the Internal Revenue Code.

What is the typical amount employers put into these accounts?

Employers implementing LSAs have different goals and different budgets, so it’s difficult to say what is ’typical,’ but contributions generally range from $500 to $2,000. We haven’t seen many below $250, because amounts less than that don’t add value when you consider the time and expense to administer the accounts. On the high end, we've seen LSAs with $3,500 or more, but typically these LSAs would be restricted to big-ticket but less utilized expenses, such as surrogacy or adoption.

Are LSA funds taxable to the employee?

LSAs with a broad range of eligible expenses are a taxable benefit. (We don’t suggest combining taxable and tax-free eligible expenses in a single LSA as that would add to complexity, create potential compliance issues and potentially forego certain tax advantages.) That said, there are different opinions on how and when LSA funds are taxed. Under the long-standing tax concept of “constructive receipt”, the full amount an employer contributes to an LSA may be treated as taxable income when first available to the employee, whether or not actually reimbursed to the employee, unless receipt or access to the funds is subject to “substantial limitations or restrictions”. However, many take the position that LSA funds are taxable only upon actual reimbursement for eligible expenses.

Some employers allocate set dollar amounts to be used only for specific expenses, in which case constructive receipt may be avoided. For example, consider an LSA benefit – whether structured as a single LSA or multiple LSAs – that provides $500 for gym memberships, $3,000 for adoption or surrogacy expenses, and $200 for home office equipment, and those dollars can't be used for any other expenses. There's a good argument, in this example, that constructive receipt doesn’t apply to the LSA(s) and funds are taxable to employees only if/when actually received. (Additionally, a separate LSA solely for home office equipment expenses may be tax advantaged to the employer and employee as a business expense). Other employers give employees an opportunity to opt out of the LSA before the tax year begins.

Those that opt out arguably aren’t in constructive receipt of the funds and aren’t taxed. It’s certainly important to discuss these issues with experienced tax advisors prior to implementation.

What could success look like?

The amazing flexibility of LSAs allow employers to get creative in using them to meet specific business objectives. Here’s an interesting potential use case: An employer analyzes turnover data and learns that their turnover spikes at six months and 12 months of employment – and that employees who get past those service markers typically stay on for five or more years. This employer could use LSAs to channel funds to a certain class of employees at six months and then again at 12 months. The reduction in turnover costs could more than make up for the cost of funding the LSA. How might you use LSAs to solve your attraction and retention issues?

Learn how Mercer data can help you. Contact us at surveys@mercer.com or 855-286-5302 today!